About Drone Insurance – Essential Protection for 2019

August 7, 2019So many people are running around trying to figure out what certifications they need, which drone will best fit their use cases, what accessories they should consider and what apps they need to look at, yet most don’t even think about a very important question… What About Drone Insurance?

It’s true. When you first think of drones, you think of fun, maybe applying it to your current occupation, starting a business and so on but insurance tends to be an afterthought if it’s thought of at all. Even then, most people think of insuring their drone for damage but there’s so much more to consider.

In today’s post, we’ll talk about the need for drone insurance, various options available, whether you should get an on-demand or term policy and even talk about some reputable options here in the US.

In the end, I hope this post helps you out and gets you thinking about what you truly need to, not only protect yourself but to protect your drone and others as well.

Table of Contents

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY AFFILIATE DISCLOSURE FOR MORE INFORMATION.

Do I Need Drone Insurance?

Do I Need Drone Insurance?

I’d have to say, in most cases, yes. This question is better addressed by asking several other questions:

Where will you be operating your drone?

Location can be a big factor in determining your insurance needs. Do you own the property you’re flying over? If so, you might not need insurance if you’re willing to accept the risk. Are you flying over someone else’s property? Even if they say they’re OK with it, who knows what will really happen if an incident occurs.

Are you flying for hire?

In most cases, this is an immediate trigger for needing insurance. Liability claims cast a wide net. The more people named in the suit allows the plaintiff to hedge their bets, so-to-speak, on getting something out of their claim. Because of this, many entities require insurance and that they are named as one of the insured, etc.

Will you be flying near/over people, animals, property, etc.?

If there’s a chance you’ll damage something or injure someone, you should get coverage to not only protect yourself but to cover any potential damages as well.

What about protecting your drone?

Accidents happen. Do you want to be stuck with the repair bills if and when it does? There are several ways to protect your investment and you should consider them if you’re not keen on spending 50% or more on repairing your aircraft should something happen down the line.

I’m sure there are other considerations but I think these four cover the majority of insurance needs.

Now, let’s talk about options…

Tell Me About Drone Insurance Options I Should Consider

Tell Me About Drone Insurance Options I Should Consider

There are so many insurance options out there. Some will cover a specific function where others will be more comprehensive and provide multiple levels of coverage. Here are some to consider:

Strict Liability

These types of policies are all about covering you should you injure someone or damage someone else’s property. There are various limits that can be obtained and it’s much like a liability-only auto insurance policy.

Hull

This is all about covering your actual drone and/or accessories. If you crash, splashdown, experience a fly-away, have it stolen, etc., hull insurance is where you make your claim.

Now, please be aware, many policies only cover certain events. There are several out there that will only payout if you can recover the drone so if you splash down in 200′ depth waters or the drone is stolen and not recovered, you may not get paid out. Some may not cover water damage at all. Be sure to know what your coverage actually is and the requirements and limitations associated with it.

Comprehensive

This is a policy that offers both liability and hull coverage. Just like all the others, coverage options may vary and they’ll have specific requirements/limitations to deal with as well.

Payload

A Payload insurance policy is all about covering whatever your drone is transporting. For most of us, this isn’t really a consideration and is really more up the alley of the package delivery drone movement. Still, it’s an option that is available.

Now, those are the primary types of coverage you can look for but there’s also:

Ground Equipment

Think of this kind of coverage as protection for your supporting equipment. Ground stations, laptops, tablets, remote controllers, cases, etc. are all part of this grouping. It’s all about policy terms. Many will leave out this equipment and require a separate policy.

Non-Owned

If you lease or operate someone else’s equipment, this type of policy might apply to you. Even if the equipment owner is insured, their insurance may not cover others operating their aircraft. Just like standard policies, this type of coverage will vary and may require separate policies for liability, hull and so on.

Personal Injury

You’d think that this coverage would be for paying out if someone was injured but it’s really about libel, slander, privacy violations and copyright infringement. With so many people claiming drones are being used to spy on them, this type of coverage is becoming more sought after.

I bet you thought I was going to list one or two coverage options… Sorry to disappoint you. I could have only listed a few, but I wanted to make sure you knew what was available out there.

Now, let’s consider time…

Should I Choose On-Demand or a Term Policy?

Should I Choose On-Demand or a Term Policy?

Just like the actual coverages you need differ, so do the length of time or term requirements. Not to worry, there are two different options available to you:

On-Demand

On-demand means just that. Buy it as you need it. This usually comes in the form of an hourly coverage and will tend to be tied to a specific location and radius at the time of purchase. I’ve used this type of coverage when I’ve flown for hire multiple times. If you fly rarely, this is more than likely the way to go. It’s convenient but it’s also pricey if you use it a lot.

Term

This is basically like all the other insurance you buy. It’s for a specific length of time but much longer than an hour. The term lengths vary widely. You can get monthly, a 6-month term, annual and so on. If you do a lot of flying this is probably the better choice for you.

If you want to test the waters, the on-demand option is a great way to feel things out. That said, the radius limitation can be frustrating if you’re running a job for a large area such as a farm or orchard. Still, you might be able to expand the coverage area by reaching out to the insuring company.

So, who are some reputable companies out there to choose from? Let’s find out…

Be Prepared to Obtain a Quote

Be Prepared to Obtain a Quote

In some instances, you may not need a lot of information to obtain insurance however, in most cases, you’ll want to have a few things handy before reaching out to the insurance company:

Your Contact Information

Name, address, contact info and so on. This is typical information any insurance company is going to want before issuing a policy. You may find out that you live in an area that a particular company doesn’t cover, etc.

Types of Coverage You’re Requesting

The insurance company is going to need to know what coverages you are looking for. In some instances, the company you want to work with may only offer certain types or levels of coverage you may actually be reaching out to multiple companies to obtain complete protection.

Costs

This applies to hull protection and will usually entail letting the insurance company know what your drone and it’s accessories cost you, how much certain replacement parts might be and so on. This allows them to tailor the policy to your needs and make sure you have adequate coverage.

UAV Details

Many companies want to know the type of aircraft you’re operating. This will also be where you let them know if you’re seeking coverage for more than one. Be aware that not all companies offer a fleet or multi-drone policy so you may end up having to ask around or obtain separate policies for each.

Planned Operating Location(s)

This can make a huge difference in your coverage costs. If you’re only going to be flying around the house, great, your policy will probably be a lot less than you’d expect but, if you’re flying all over the country (or even outside of it), you can expect the policy to be much more expensive and will need to verify where you’re covered vs where you’re not covered (which you should verify regardless of the policy you choose).

Pilot Experience/History

Just like auto insurance, rates can be affected by your experience. Letting them know you have a certain certificate or exemption grant, completed course X or have Y number of hours under your belt can go a long way toward lowering that rate.

On the other side of the coin, they’re going to want to know if you’ve had other incidents (including accidents and/or loss). These events are kind of like points on your driver’s license and can push the rate up.

I’m sure there are other considerations but these are the ones that come to mind as I’m writing this article. Just be aware that you may need to provide this information when you reach out to the insurance companies.

What Are Some Reputable Options in the US?

What Are Some Reputable Options in the US?

OK. So you know what type of insurance and coverage options and you’re looking for and you’re ready to answer the insurance companies questions. Which companies should you look into? The answer to this will be largely based on your entity status. What I mean by this is are you flying privately or commercially? Knowing this will change the options available to you.

Current Insurer

The first place to look is with your current insurer. For the individual, reach out to your homeowner’s policy provider. I hear State Farm is excellent for this but doesn’t offer coverage in California, etc. For the business owner, reach out to your business insurance representative. In either case, many times, hull coverage can be added with ease. Sometimes, liability as well.

On-Demand

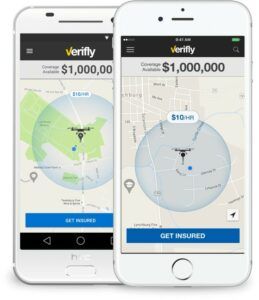

I’ve used Verifly quite a bit and I like them for small jobs. Another option is SkyWatch but I’m not really familiar with them myself.

Drone Insurance Brokers

There’s no shortage of brokers out there that deal with drone insurance. Here are a few to consider but the list is much longer and you should do a bit of research before making a final decision: Avion Insurance, Quote Zebra, SkySmith, UAV Protect, etc.

Drone Insurance Underwriters

These are the guys that evaluate you and your needs. Again the list is long, so I’m only offering a few here. Be sure to do your own research to find the right fit: AIG, Global Aerospace, Lloyd’s, USAIG, etc.

In the end, my top picks would be Current Insurer, Drone Insurance Brokers and On-Demand, in that order (with the exception of On-Demand being my first pick for those that seldom fly).

Great, now you’re ensured. Be sure to keep that coverage…

Things to Track Once Insured

Things to Track Once Insured

Just like any other insurance policy, you can be dropped. Let’s see what you need to do and look out for to keep that protection going…

Keep Records

This is probably the most important one. If you don’t log your flights or have a way to prove what happened during an accident (such as being able to product flight data), you could be dropped as a client.

Proper Identification

The FAA already requires registration and proper ID placement on your drone. Many insurance companies expect that you follow similar procedures or risk being dropped.

Proper Maintenance and Record-Keeping

This is especially true for the part 107 commercial pilot but still applies to the hobbyist as well. Perform recommended maintenance tasks and keep records of said maintenance. This includes battery charging cycles and simple things like prop replacement.

Inappropriate Flying/Hot Dogging

Have you seen any YouTube videos that make you cringe or just wonder what that person was thinking? Similar actions on your part can lead to being dropped by your insurance company. Fly responsibly and don’t post evidence that could get you in trouble.

Conclusion

As you can see, there’s a lot to know About Drone Insurance. The information above should have you reasonably prepared to seek and obtain the coverages you want and need and to take the necessary steps toward maintaining that coverage.

Now I’d like to hear from you… Do you currently have insurance? If so, are you happy with your provider and coverage options? Have you had any claims and how was the overall experience of dealing with them? Is there a provider or coverage consideration I haven’t listed here? Did this post help you at all? I’m really interested in your thoughts. Please let me know by commenting below.

Also, if you don’t yet have a drone and are looking at your options, consider reading some of my review articles. Of particular interest are the following:

What is the- DJI Mavic Pro – Only One of the Best Drones Ever

The DJI Mavic 2 – The New Models are Finally Here!

Thank you,

Scott Hinkle

MavicManiacs.com